![]() Home > Thailand

Home > Thailand

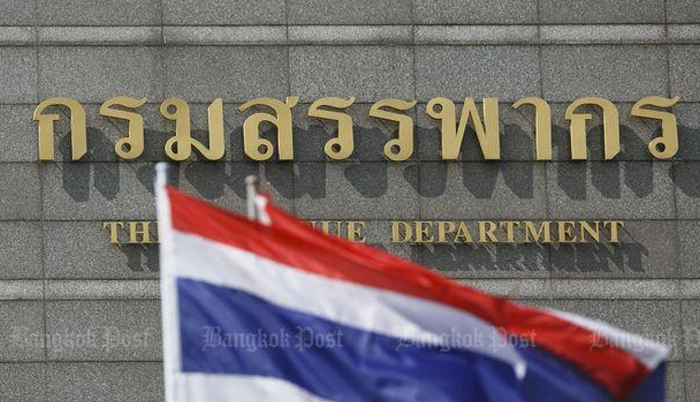

Tax Evaders May Face Asset Seizures

![]() April 3rd, 2017 | 08:19 AM |

April 3rd, 2017 | 08:19 AM | ![]() 1396 views

1396 views

BANGKOK

Evading taxes worth 10 million baht or more, or fraudulently filing for tax refunds of 2 million baht or more through collusion, shall be considered a money-laundering offence, according to a new law taking effect on Sunday.

The amendment to the Revenue Code published in the Royal Gazette on Saturday added a provision on tax penalties.

In essence, it classifies evading taxes of 10 million baht or more per tax year, or fraudulently filing for tax refunds of 2 million baht or more through collusion, as a money-laundering offence.

"Once the Revenue Department, with the approval of the tax offence screening committee, sends the information of such a case to the Anti-Money Laundering Office, action can be taken under the Anti-Money Laundering Act."

Such action includes immediately seizing the assets of the offenders for 90 days if there is "probable cause" that they might be moved or transferred.

The screening committee comprises the Revenue Department director-general, his deputies and revenue advisers.

The law cited as a reason for the change compliance with the terms of references of the Asia Pacific Group on Money Laundering (APG).

"As a founding member of the APG, Thailand needs to comply with the terms of references, which require member countries conform to the guidelines of the Finance Action Task Force (FATF)."

The law also aims to enhance efficiency in suppressing tax evasion and fraud.

Source:

courtesy of BANGKOK POST

by BANGKOK POST

If you have any stories or news that you would like to share with the global online community, please feel free to share it with us by contacting us directly at [email protected]