![]() Home > World Business

Home > World Business

Saudi Debt Binge Amid Oil Gains Eases Bank Liquidity Drought

![]() April 14th, 2017 | 09:11 AM |

April 14th, 2017 | 09:11 AM | ![]() 757 views

757 views

SAUDI ARABIA

Saudi Arabia’s repeat visits to international bond markets and a partial recovery in the price of oil, its biggest export, is easing a liquidity squeeze that was hampering its financial system.

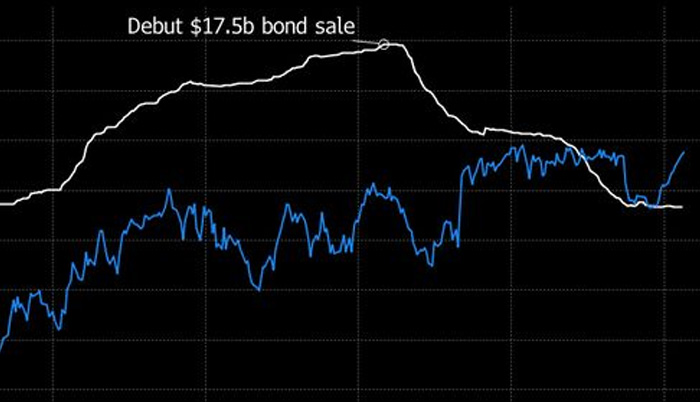

As the country finalized its first issue of dollar-denominated Islamic notes, six months after selling the biggest ever bond by an emerging market country, an interest rate used by Saudi banks to price loans stood at its lowest level in almost 14 months. That rate, known as Saibor, will probably fall further after the latest sukuk issue, according to Anita Yadav, head of fixed-income research at Emirates NBD PJSC, Dubai’s biggest bank.

Saibor has been falling since reaching a seven-year peak of 2.386 percent on October 17, immediately before the country’s debut dollar-bond sale, as oil export revenue dwindled, sending the state budget into deficit. Cost cutting by a government usually associated with vast reserves of petrodollars, and a drawing down of its bank deposits to prop up spending, prompted a cash squeeze in the economy, helping drive Saibor higher.

“Saudi Arabia is doing these jumbo bond deals, like the sukuk yesterday, that will bring money into the country and ease bank liquidity further,” Yadav said.

The Saudi financial system is also benefiting from a doubling in oil prices since they hit a 12-year low in January 2016. Saudi banks’ combined loans-to-deposit ratio, a key measure of liquidity, improved to 88.1 percent in February from 90.8 percent in August, according to central bank data. Bank lending grew 2.8 percent in 2016, the slowest pace since 2009, according to central bank data.

In the Red

Still, the Saudi budget remains in the red and the deficit will probably be 7.6 percent of output this year, according to the median estimate of 11 analysts polled by Bloomberg.

That means government spending cuts may continue, hurting growth and reducing demand for investment funds. Loan demand in Saudi Arabia will be "subdued" this year, Moody’s Investors Service said last month, while economic growth is likely to slow to 0.4 percent in 2017, the weakest in nine years, the International Monetary Fund forecast.

But with oil firmly above $50 a barrel and the Saudi government proving it can tap international investors for enough liquidity to pay its bills, the economy has some breathing space. Brent crude was 0.1 percent higher at $55.9 a barrel at 2:13 p.m. in Dubai on Thursday.

There has been a "significant improvement in liquidity in the kingdom over the past three or four months," James Reeve, the London-based senior economist at Samba Financial Group said in an email. This has been due to "waning demand for private credit and the fulfillment of outstanding invoices by the government."

Source:

courtesy of BLOOMBERG

by Arif Sharif

If you have any stories or news that you would like to share with the global online community, please feel free to share it with us by contacting us directly at [email protected]