![]() Home > World Business

Home > World Business

Russia's $4 Billion Bond Sale Defies U.K. Spat As Bids Roll In

![]() March 17th, 2018 | 10:53 AM |

March 17th, 2018 | 10:53 AM | ![]() 558 views

558 views

RUSSIA

A deepening diplomatic spat with the West and a fresh round of penalties weren’t enough to deter investors from bidding for almost double the $4 billion of eurobonds sold by Russia.

Institutional investors from the U.K. snapped up half the 2047 notes on offer Friday, while Russians were the biggest buyers of a new 11-year bond, according to organizer VTB Capital. In a break from convention, Finance Minister Anton Siluanov said in December that local investors would be given priority in the sale as part of a Kremlin move to encourage wealthy Russians to repatriate capital.

The debt sale wound up a turbulent week as the U.S. announced fresh penalties over alleged election meddling by the Kremlin and the U.K. expelled Russian diplomats after the poisoning of an ex-spy on British soil. While some international investors said they were put off by the geopolitical fractures, others were less squeamish.

“The sovereign isn’t sanctioned, so investors have to take the new issue very seriously,” said Richard Segal, a senior analyst in London with Manulife Asset Management, a $400 billion money manager. “Some may pass due to the geopolitical situation and therefore the yield may be higher than it would have been otherwise.”

Four-Year Standoff

The risks posed by Russia’s four-year standoff with the West were laid out prominently in the bond prospectus accompanying the sale. While no mention is made of the poison attack in the U.K., investors are warned that political and economic tensions have contributed to capital outflows and the depreciation of foreign exchange reserves.

“The fact that Russian risk continues to see strong demand from foreign investors against a backdrop of negative news is confirmation of Russia’s ability to borrow for long periods at market levels,” Siluanov told reporters after the sale. Russia may return to foreign debt markets later this year with bonds in different currencies and maturities, he said.

Key Numbers:

Total demand was about $7.5 billion, according to Andrey Solovyev, global head of DCM at VTB Capital

While U.K. investors dominated the $2.5 billion tap of existing 2047 bonds, buyers from the U.S. took a 20 percent share of the notes, which were sold at 5.25 percent

U.S. investors bought 34 percent of the $1.5 billion of new 11-year bonds, making them the biggest participants after the Russians, who took 35 percent

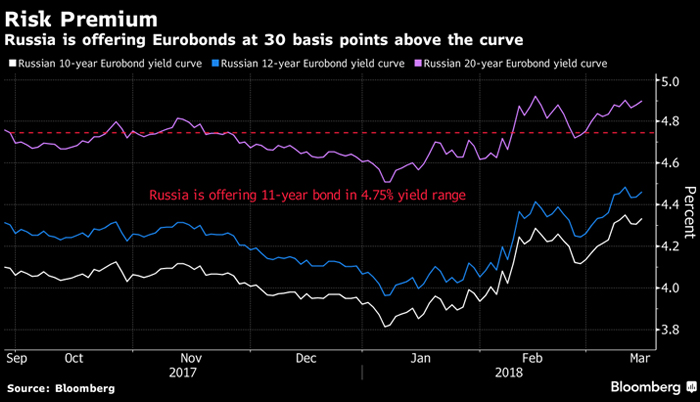

The yield on the 2029 bond was narrowed to 4.625 percent from about 4.75 percent, putting it about 20 basis points above similar-maturity debt

In order to increase the appeal for domestic buyers, holders of the 2029 bond have the option of getting payment in rubles

The Finance Ministry will use $3.2 billion from the sale to buy back eurobonds due in 2030

A recent ratings upgrade out of junk by S&P Global means that Russia is now included in investment-grade indexes, increasing the pool of investors who will automatically hold a portion of the new bond when it is sold.

James Barrineau, the New York-based co-head of emerging-market debt at Schroders Plc. said he was skipping the sale because the sanctions risk is still high.

“We don’t find a lot of value here,” Barrineau said. “Russian dollar debt has fully priced in improving fundamentals and remains at risk of more sanctions noise.”

Source:

courtesy of BLOOMBERG

by Ksenia Galouchko and Lyubov Pronina

If you have any stories or news that you would like to share with the global online community, please feel free to share it with us by contacting us directly at [email protected]