![]() Home > World Business

Home > World Business

Morgan Stanley, Goldman Warn Of Valuation Risk As Earnings Wilt

![]() September 19th, 2022 | 21:06 PM |

September 19th, 2022 | 21:06 PM | ![]() 700 views

700 views

WORLD BUSINESS

After a hotter-than-expected inflation print and FedEx Corp.’s shocking profit warning, top Wall Street strategists see mounting risks for US earnings and equity valuations.

Both Morgan Stanley’s Michael J. Wilson and Goldman Sachs Group Inc.’s David J. Kostin said headwinds to profitability are building, highlighting tighter monetary policy and pressure on company margins as key concerns. According to Wilson, who has been one of the most vocal bears on US stocks, “there is still a long way to go before reality is fairly priced.”

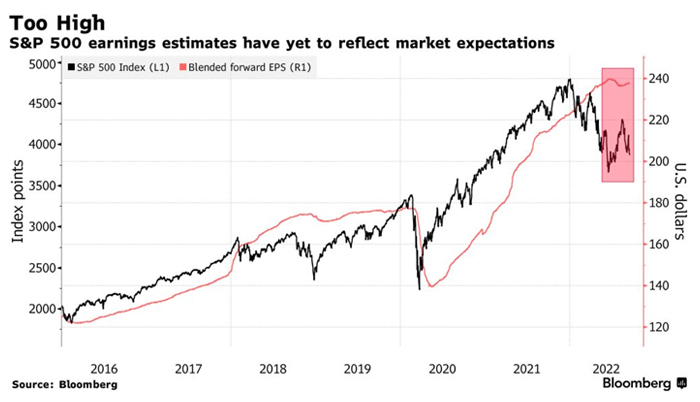

While analysts’ estimates for US company earnings have been moderating recently, they are still near record highs -- despite a 19% slump for the S&P 500 benchmark this year. Revisions “are often glacial,” amid dependence on corporate guidance and due to the relatively defensive nature of the US index, Morgan Stanley’s Wilson wrote, warning of volatility ahead.

The strategists’ comments come after a rough week for US stocks which saw the benchmark gauge drop 4.8% and the technology-heavy Nasdaq 100 post its worst week since January. Data showing consumer prices rose more than expected in August fueled fears about supersized Federal Reserve rate hikes, while FedEx’s warning was touted by some as the first of many to come from struggling companies.

The “hot inflation print stoked concerns about the outlook for equity valuations and profitability,” said Goldman’s Kostin. His team expects S&P 500 net profit margins to fall 25 basis points in 2023, weighing further on returns on equity.

The Goldman strategists said stocks with high returns on capital stand out in a backdrop of rising pressure on profitability and tighter financial conditions. They highlighted companies including Alphabet Inc., Domino’s Pizza Inc. and Philip Morris International Inc.

Meanwhile, Wilson and his team “continue to recommend owning more defensively oriented companies with earnings stability and high operational efficiency.”

Bank of America Corp. strategist Michael Hartnett echoed Morgan Stanley’s view last week, saying US equities haven’t yet seen the worst of this year’s declines amid scorching inflation and a hawkish Fed. Hartnett and his team expect an earnings recession to drive stocks to new lows.

Source:

courtesy of BLOOMBERG

by Farah Elbahrawy

If you have any stories or news that you would like to share with the global online community, please feel free to share it with us by contacting us directly at [email protected]