![]() Home > World Business

Home > World Business

India Releases Tax Data Heeding Piketty's Call for Transparency

![]() May 1st, 2016 | 08:27 AM |

May 1st, 2016 | 08:27 AM | ![]() 1470 views

1470 views

INDIA

India’s government released a backlog of income-tax data that the French economist Thomas Piketty had been repeatedly calling for. But the findings may not please the author of “Capital in the Twenty-First Century”.

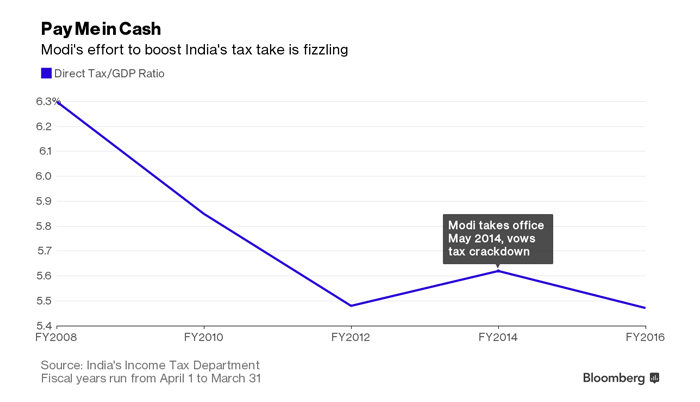

Direct taxes as a share of the economy have fallen to 5.47 percent in the year that ended in March, the lowest in almost a decade, despite Prime Minister Narendra Modi’s pledge to crack down on so-called “black money”.

The data published on Friday isn’t entirely bad for a government that curbed its budget gap to 3.9 percent of gross domestic product last year after it enjoyed in surge in indirect collections due to increased taxes on fuel. Yet India, which has the lowest revenue as a share of GDP among emerging markets, needs more resources to spend on health and education.

Arvind Subramanian, the Finance Ministry’s chief economic adviser who sparred with Piketty in January over the need to increase tax revenues, tagged him when announcing the data release on Twitter. Piketty had urged the government to raise taxes and release data on collections.

Direct taxes -- mainly on corporate and personal income -- accounted for just 51 percent of total taxes last year, signaling sluggishness in Asia’s third-largest economy. That compares with 56 percent a year earlier, and as much as 61 percent in 2009-10. Maharashtra, home to Mumbai, the country’s financial capital, repeatedly brings in the largest contribution, or 40 percent of all direct taxes last year.

More interesting to Piketty, whose research focuses on wealth and inequality, is a somewhat dated but detailed report that lists contributors by income brackets. Only 29 million, or about 2 percent of India’s 1.3 billion population, filed their income tax returns in the year ended March 2013. The largest group of tax payers earned an average of 694,000 rupees ($10,441) while just six people declared an average income of 687.2 million rupees.

Source:

courtesy of BLOOMBERG

by Sandrine Rastello

If you have any stories or news that you would like to share with the global online community, please feel free to share it with us by contacting us directly at [email protected]