![]() Home > Singapore

Home > Singapore

DBS' Second Outage In 16 Months 'Unacceptable', Bank Has 'Fallen Short' Of Expectations: MAS

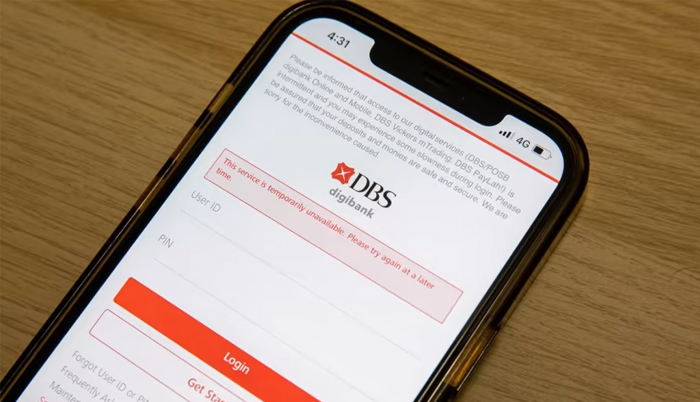

DBS' internet banking login page showing an error message on March 29, 2023 | Ili Nadhirah Mansor/TODAY

![]() March 30th, 2023 | 06:59 AM |

March 30th, 2023 | 06:59 AM | ![]() 394 views

394 views

SINGAPORE

The disruption of DBS’ digital services due to an outage on March 29 is “unacceptable", the Monetary Authority of Singapore said

The central bank noted that this happened just a year after a two-day outage in November 2021

It added that DBS has fallen short of its expectations to maintain high system availability and ensure its IT systems are recovered quickly

DBS' CEO Piyush Gupta said that it is the bank's "utmost priority" to review the incident and it deeply regrets the inconvenience caused

The disruption of DBS bank’s digital services on Wednesday (March 29) is “unacceptable", coming a year after a similar incident in November 2021, the Monetary Authority of Singapore (MAS) said.

"DBS has fallen short of MAS’ expectations to maintain high system availability and ensure its IT systems are recovered expeditiously," the central bank added.

Digital services for the Singapore bank were down for most of Wednesday.

Its digital banking services also previously suffered a two-day disruption in November 2021.

In a statement on Wednesday night, DBS' chief executive officer Piyush Gupta said the bank is disappointed that many of its customers were affected by the outage.

"We hold ourselves to higher standards and it is our utmost priority to review the events of today," he added.

"We acknowledge the gravity of the situation, appreciate our customers' understanding, and deeply regret the inconvenience caused."

In response to TODAY’s queries earlier, MAS said on Wednesday that it will take “commensurate supervisory actions” against DBS after gathering the necessary facts.

It has instructed the bank to conduct a thorough investigation to establish the root cause of the disruption and submit its investigation findings to MAS.

It added that DBS had notified MAS early on Wednesday that its customers were experiencing difficulties in accessing its digital banking services.

MAS has been in close contact with the bank since then to speed up the recovery of its digital services and to ensure timely communications to customers on the disruption, it said.

In response to TODAY’s queries, DBS said at 7.30pm that as of 5.45pm, its digital services — Digibank Mobile and Online, PayLah! and mTrading — had returned to normal.

Its customers had been unable to log in to e-banking platforms such as the PayLah! mobile wallet, with reports of service outages beginning to surge at about 8.30am, the Downdetector website showed.

In the wake of the 2021 incident, which MAS deemed a "serious disruption", the authority had imposed more capital requirements on DBS, which had to apply a multiplier of 1.5 times to its risk-weighted assets for operational risk.

That translated to S$930 million in additional regulatory capital, MAS said in February last year. The sum was based on DBS' reported financial statements as of Sept 30, 2021.

Source:

courtesy of TODAY

by CHARLENE GOH

If you have any stories or news that you would like to share with the global online community, please feel free to share it with us by contacting us directly at [email protected]